how to salary sacrifice super

As youll essentially be taking home less money each pay cycle you should consider how much of your income you can afford to give up. Open the employees card and click the Payroll Details tab.

Standard Salary Sacrifice Agreement Rei Super

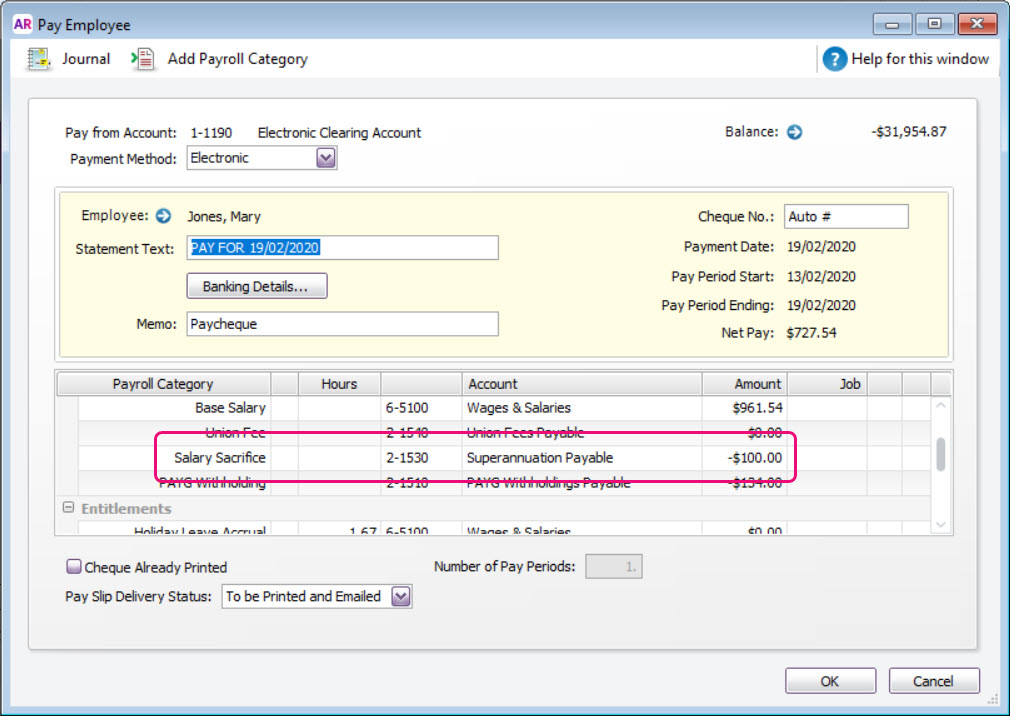

Click Standard Pay and specify the amount of super to be deducted for this employee next to the Salary Sacrifice category.

. Set up super salary sacrifice RESC for an employee In the Payroll menu select Employees. Salary sacrificing for super involves contributing pre-tax dollars from your salary into your superannuation account. Your salary sacrifice contributions are limited by the concessional contributions cap available to you.

This means the money going into your super account is from your pre-tax salary. If you earn less than 289473 gross annually your mandatory employer contributions will be under the new non-concessional cap. Decide on a set dollar amount or percentage to salary sacrifice.

If the amount is on top of the gross that is more likely to be a company contribution. Select the Pay Template tab then click Add Superannuation Line. Remember once it has been contributed to super you cant touch it again until you retire.

Select the superannuation fund to pay the super salary sacrifice from. Click the employee you want to set up super salary sacrifice for. A salary sacrifice is for when someone has X gross and then deducts an amount from that gross amount.

Salary sacrificing is simply choosing an amount of money for your employer to put into your super account rather than your usual bank account every time you get paid. In this video well look at how to setup and process a Superannuation salary sacrifice agreement in XeroWell also cover off a couple of common scenariosTO. Set up the salary sacrifice superannuation category with the CalculationBasis set to User - Entered Amount per Pay Period.

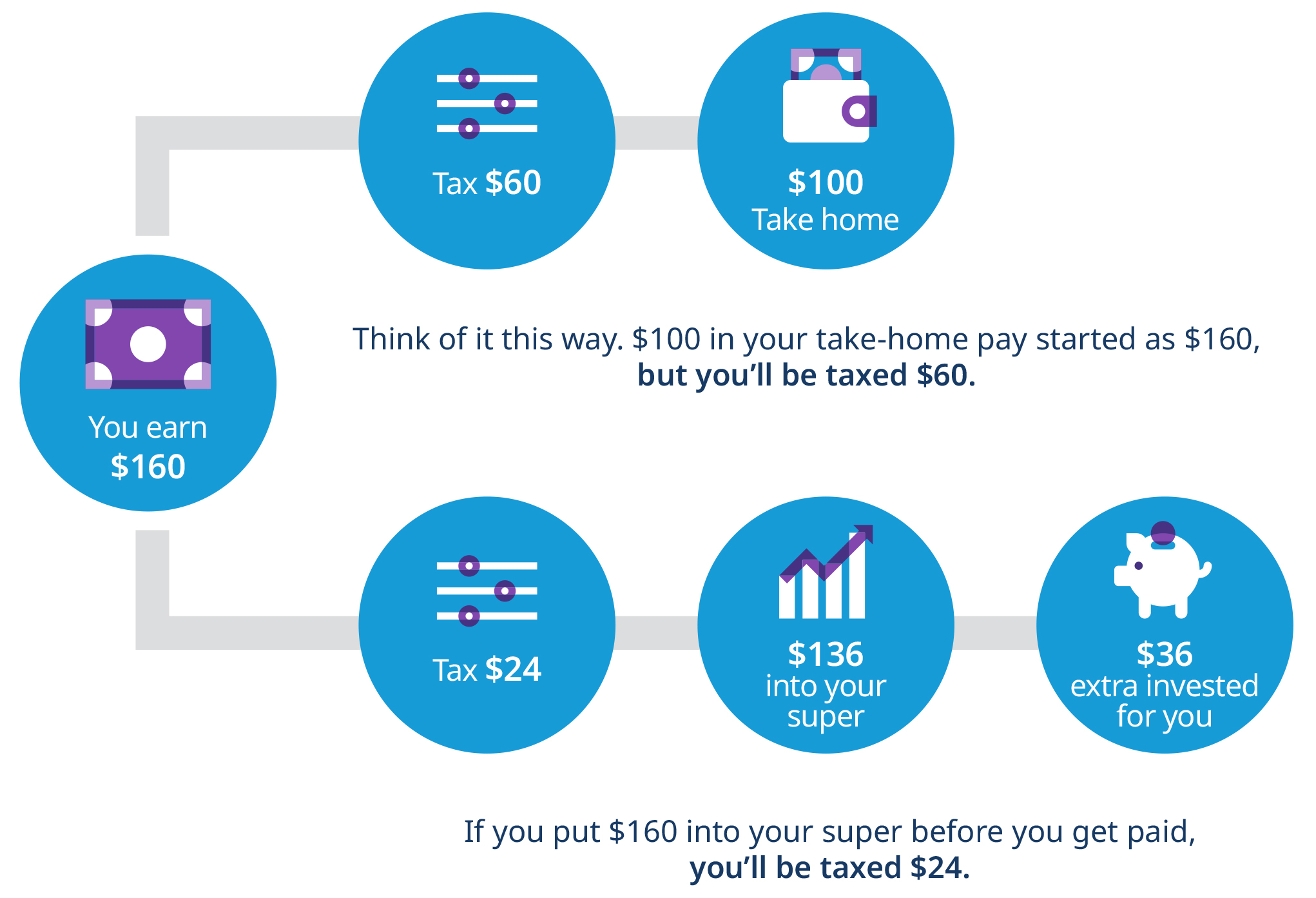

You still need to be able to cover your lifestyle expenses and any upcoming capital expenses. How salary sacrificing into super works OK so this is how it works. This is an extra amount on top of your employers compulsory super contribution.

Remember to enter this as a negative value. If the salary sacrifice is for super then the amount is accrued as a component of super payable that is then remitted to the nominated super fund. Your employer is legally obliged to contribute 95 of your salary into your super and you are able to contribute extra - up to 25000 in concessional contributions pre-tax and 100000 in non-concessional contributions after tax.

To January 2020 the amount the employer paid for SGC was reduced by the salary sacrifice amount. They include personal before-tax contributions you make via salary sacrifice Superannuation Guarantee contributions your employer pays for you and any after-tax personal contributions you make and claim a tax deduction for. You can use this email template to let them know.

Before you commit to salary sacrifice you can see how it could work for you by using our contributions calculator. How to add a super salary sacrifice item to an employees pay in Reckon Account Hosted. Alternatively you may choose to make salary sacrifice contributions through a 3 rd party like Maxxia.

Every dollar you put into your super today can keep growing for when you retire. Remember youll need to factor in your employer contributions to make sure you dont exceed the cap. One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you.

If you are nowhere near hitting the concessional cap consider salary sacrificing some extra fortnightly. Salary sacrifice is an arrangement between you and your employer to contribute a portion of your salary to your superannuation account before you pay tax on it instead of it being part of your take home pay. Its a redirection to your future self.

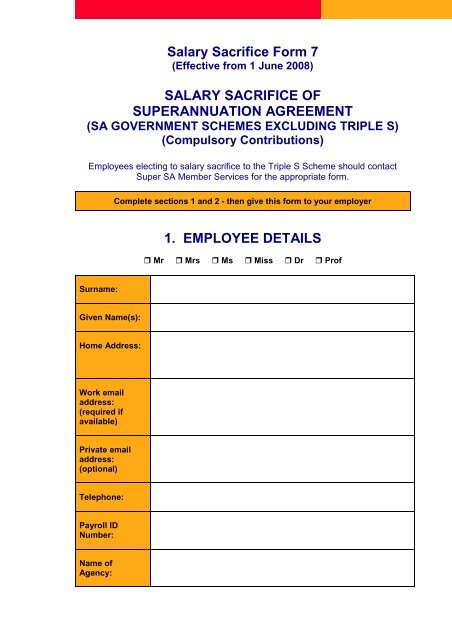

For 202122 this cap is 27500. Click below to download your schemes form. How does salary sacrificing into super work.

Investments held in super receive significant tax advantages both before and throughout. If your employer makes super contributions for you through a salary sacrifice. Select Salary Sacrifice to Super as the type of deduction.

Only salary sacrifice as much as you can afford. You may be able to contribute more under the carry-forward rule. If you choose to reduce your before-tax income by salary sacrificing into super a potential benefit is you may be able to reduce what you pay in income tax for the financial year.

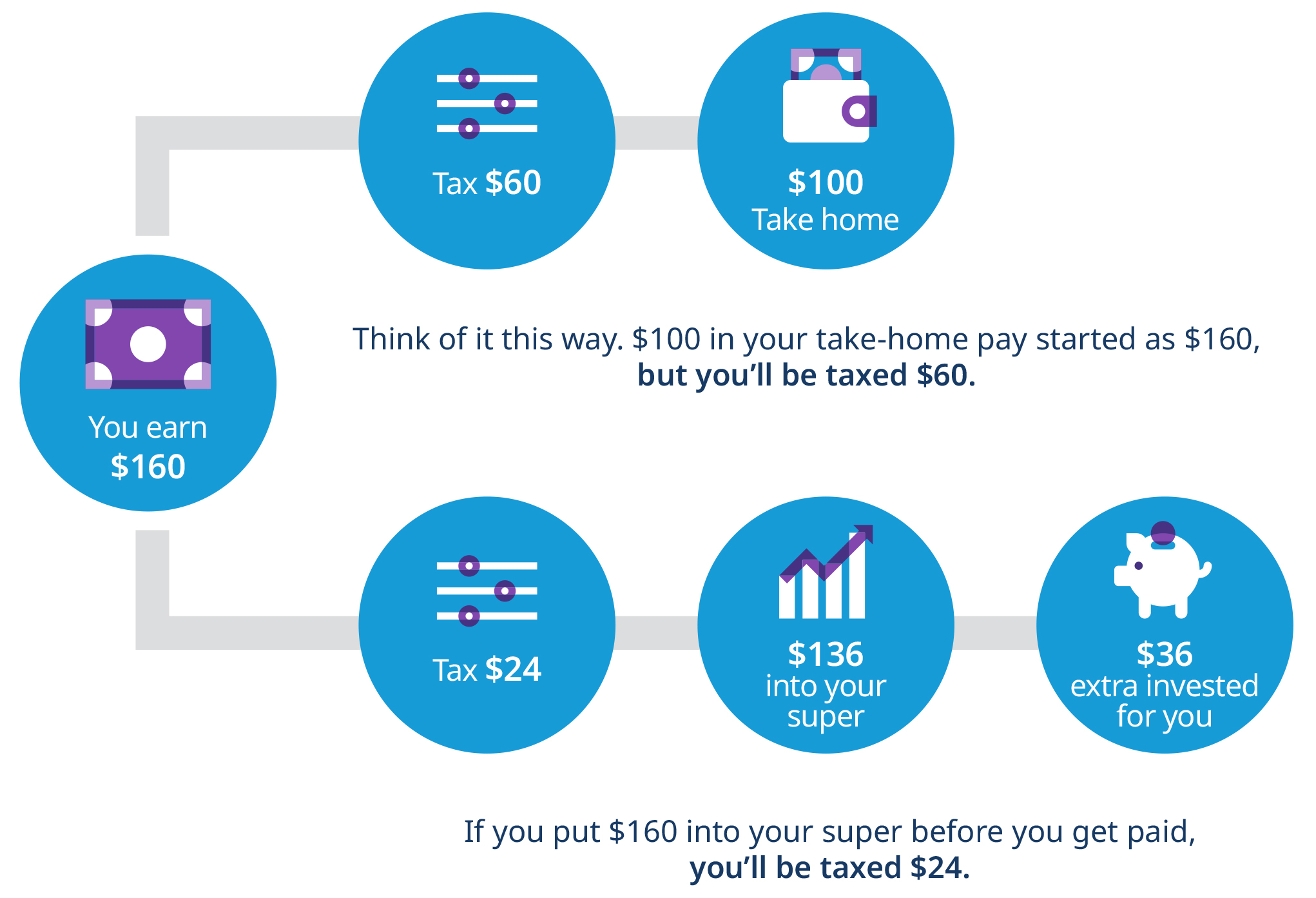

Make sure the amount you salary sacrifice doesnt cause you to exceed the concessional contribution cap of 27500 per. Enter the or amount 100 in this case set the payment method to pay a super fund and select a fund from the drop down menu choose the. Thats because contributions made via a salary sacrifice arrangement are only taxed at 15 if you earn under 250000 a year or 30 if you earn 250000 or more a year with most people.

Now the amount of the SGC is based on the total OTE wages including salary sacrifice component. When you salary sacrifice you arrange with your employer to contribute an additional amount to your super out of your pre-tax pay. Ask your employer to arrange to have extra contributions made to your Sunsuper account via salary sacrifice.

Select the way the amount will be arrived at. Salary sacrificing to super Before-tax or concessional contributions are super contributions that come out of your before-tax pay. Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value.

Loading calculator please wait. Ensure you consider the effect of salary sacrifice on HECSHELP repayments and. To set one of those up.

How much can I salary sacrifice to super. They can usually make the arrangement on your behalf. Step 2 - Make it happen.

It involves setting up an arrangement between you and your employer where you agree to contribute an additional amount into your super from your pre-tax income. How much salary sacrifice into super. Filling in the form is easy and shouldnt take more than 15 minutes.

Click here to download. To sacrifice some of your salary into your super account you make an agreement with your employer for them to pay some of your salary straight into your super fund rather than into your bank account with the rest of your salary. Put your mouse over the cog in.

Click here to download.

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

Salary Sacrifice Form 7 Superfacts Com

What Are The Benefits Of Salary Sacrifice Supercontribution

13 How Does Salary Sacrifice Work Youtube

Upgrade Your Future With Salary Sacrifice Mercer Financial Services

Salary Sacrifice Forrest Private Wealth

Salary Sacrifice More Super Less Tax Wealth Depot Financial Advisers

0 Response to "how to salary sacrifice super"

Post a Comment